EXHIBIT 4 Specification Format for MTD Text File Data. These monthly deductions are retained by your employer and paid over to the.

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

So follow my step-by-step below on how to calculate PCB using the PayrollPanda PCB calculator.

. Borang PCB TP3 2010. SPECIFICATION FOR MONTHLY TAX DEDUCTION MTD CALCULATIONS USING. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian.

PCB TP1 FORM 2010. Simple PCB Calculator provides quick accurate and easy calculation to. Borang PCB TP1 2010.

Subtract 12 from annual tax to calculate PCB per month. If you need more flexible and better payroll calculation such as generating EA Form automatically or adding allowance that does not contribute to PCB EPF or SOCSO you may want to check out HRmy - Free Malaysian Payroll and HR Software which is absolutely FREE. MTD stands for Monthly Tax Deduction also known as Potongan Cukai Bulanan PCB.

The acronym is popularly known for monthly tax deduction among many Malaysians. Inversely if the previous PCB was. Malaysias tax authorities provide an official PCB calculator here.

EPF SOCSO EIS PCB MTD Calculate your salary EPF PCB and other income tax amounts online with this free calculator. PCB stands for Potongan Cukai Berjadual in Malaysia national language. LEMBAGA HASIL DALAM NEGERI MALAYSIA AMENDMENT TO.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. Employee is not resident in calendar year 2020. An employee whose monthly salary is RM 5000 plus RM 5000 bonus per year will have a combined tax of RM 650 if.

Calculate your taxable salary Taxable Salary Gross Salary EPF EPF is equals to your 11 gross salary. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. 1 Normal Remuneration Normal remuneration is a fixed monthly salary.

Simple PCB Calculator provides quick accurate and easy calculation to Malaysian. With a separate assessment both husband. For this purpose PayrollPanda had created a simple and easy to use PCB calculator.

Explanatory Notes MTD 2010. But lets say we underpaid the PCB in January and only paid RM67 the February PCB will be calculated as 1200 - 67 11 RM103. Explanatory Notes MTD 2013.

Monthly Tax Deduction PCB and Payroll Calculator Tips Calculator based on Malaysian income tax rates for 2019All married couples have the option of filing individually or jointly. The acronym is popularly known for monthly tax deduction among many Malaysians. For these examples we have made some changes to make it easier to follow.

MTD of an employee who is not resident or not known to be resident in Malaysia shall be calculated at the rate of 30 of his remuneration. Nota Penerangan Jadual PCB 2012. PCB calculator Tax calculator EPF Payroll Sosco and EIS.

Borang PCB TP2 2010. Total monthly remuneration RM 500000. Form PCB 2II d.

Heres the calculation. Also check your PCB EPF EIS and SOCSO calculations. MTDPCB is a series of monthly deductions that go towards your tax payment in relation to your employment income.

The amount of Monthly Tax Deduction to be rounded up to the nearest five cents as follows. Kalkulator PCB Lembaga Hasil Dalam Negeri. For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary.

Generate payslips for FREE with PayrollPandas Payslip Generator. Access to the PCB calculator. This is the example is based on the most common example of PCB calculation for bonus found online.

Calculate annual tax based on chargeable income and current tax rates. The acronym is popularly known for monthly tax deduction among many Malaysians. PCB TP2 FORM 2010.

Calculation method of Monthly Tax Deduction MTD 2022 are as follows. You can easily get access to the PCB calculator through the PayrollPanda PCB calculator page. PCB stands for Potongan Cukai Berjadual in Malaysia national language.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. Net PCB RM 500000 x 28. It is similar to the example found on the LHDN examples for 2008 bonus calculations found at LHDN website.

Find your PCB amount in this Income tax PCB 2009 Chart. Or you can try an alternative PCB Calculator like these - although its worth noting that these calculators are provided for guidance only. Nota Penerangan Jadual PCB 2013.

Inland Revenue Boards Kalkulator PCB. PCB TP3 FORM 2010. A simplified payroll calculator to calculate your scheduled Monthly Tax Deduction aka Potongan Cukai Berjadual.

Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022. Forever for UNLIMITED employees. Calculate monthly PCB by dividing annual tax by 12.

Simple PCB Calculator is a monthly tax deduction calculator to calculate income tax required by LHDN Malaysia. How Is PCB Bonus Calculated. Explanatory Notes MTD 2012.

EPF deduction is restricted to RM500 only any amount above RM500 is consider lost. This table is valid until year 2021 and may be changed from year to year. BTW Payrollmy PCB calculator 2020 is powered by HRmys.

Nota Penerangan Jadual PCB 2010. INCREASE OF TAX RELIEF FOR UP-SKILLING AND SELF-ENHANCEMENT. The PCB calculation is only take EPF as deduction.

Hence you may realize that MTD and PCB can be used interchangeably. R Tax rate. See the table below.

P Yearly Taxable Income step b M First chargeable income range. In February payroll the PCB will be calculated as 1200 - 100 11 RM100. And the best part is it is FREE.

A total monthly salary of. B Amount of tax on M after deduction of tax rebate. If the annual tax is RM1200 the PCB in January payroll will be calculated as 1200 12 RM100.

Calculations is limited to two decimal points only and omit the subsequent figures. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers. D Get the Yearly Taxable Income for Basic Salary and Bonus.

Method 1 Manual PCB calculation for Bonus using PCB Schedule. How Is PCB Calculated In Malaysia. The net PCB should be 28 percent of an employees salary if he or she is not a Malaysian resident.

A resident employees PCB calculation are categorised into four formulas. Calculate monthly tax deduction 2022 for Malaysia Tax Residents. Monthly Tax Deduction for additional remuneration based on Computerised Calculation shall be subject to the followings.

PCB stands for Potongan Cukai Berjadual in Malaysia national language. Total monthly remuneration.

Clearing Up Trace Impedance Calculators And Formulas Blog Altium Designer

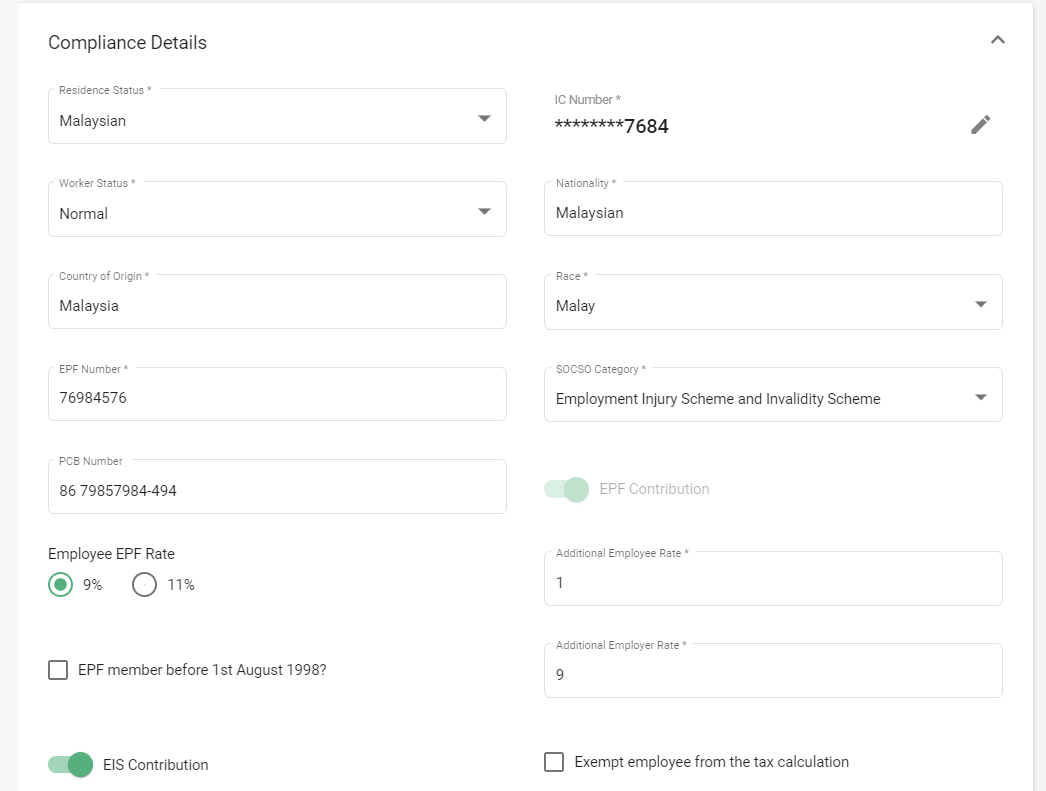

Pcb Mtd Tax Calculations Payroll Support My

Pcb Mtd Tax Calculations Payroll Support My

How To Calculate Mtd Pcb Formula In Your Payroll

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Why Pcb Design Generally Controls 50 Ohm Impedance

Excel Template For Pcb Bonus Calculation Actpay Payroll

Excel Template For Pcb Bonus Calculation Actpay Payroll

Malaysia Payroll System Pcb Calculation Malaysia Tax

Differential Pair Impedance Using A Calculator To Design Your Pcb Pcb Design Blog Altium Designer

Malaysian Bonus Tax Calculations Mypf My

How To Calculate Monthly Pcb Income Tax In Malaysia Mkyong Com

Pcb Mtd Tax Calculations Payroll Support My

Pcb Calculation For Year 2021 Budget 2021 Summary

Malaysia Payroll How Is Mtd Pcb Calculated In Deskera People

3 Ways To Do Bonus Calculation Pcb Without Payroll Software

Using An Ipc 2152 Calculator Designing To Standards Pcb Design Blog Altium

3 Ways To Do Bonus Calculation Pcb Without Payroll Software